Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

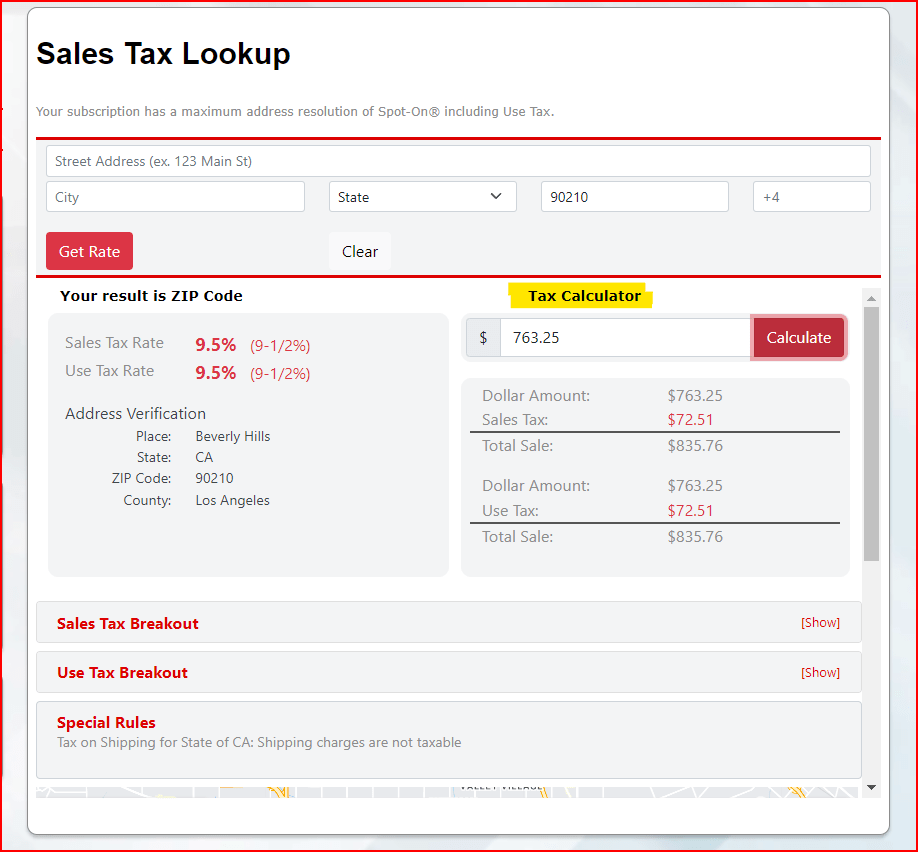

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.

Sales & Use Tax Online Lookup

All prices are for a one-year subscription. You can cancel within the first 15-days for a full refund.

Your choices are: "Sales Tax" or "Sales & Use Tax", A ZIP code detail level, The number queries you estimate using each month.

Sales Tax API

The Sales Tax API will connect you to our servers when you need a rate. Basic, ZIP+4, or full street address.

Our secure API connects seamlessly to our constantly updated servers, ensuring your online retail transactions are always in line with the most current sales and use tax rates. Elevate your checkout process and automate the sales tax calculation with precision, catering to customers at the point of sale.

Find All Canada Sales Tax Rates in One Table

Navigating the intricate sales tax system of Canada is made straightforward with Zip2Tax's Canadian Sales Tax Table.

In Canada, the sales tax is commonly referred to as the "Goods and Services Tax" (GST) at the federal level and the "Provincial Sales Tax" (PST) or "Harmonized Sales Tax" (HST) at the provincial level. The tax structure varies depending on the province or territory.

One Canada tax table breaks out the GST/HST/PST/QST/RST rates for all Canadian Postal Codes. Updated monthly. For a sample of the Canada format, click here. Download a file one time, or choose a 12-month subscription.